Commercial lending made easy.

Solve your lending bottlenecks with digital experience and AI –

so you can 2x loan volume and turnaround loans in days, not weeks.

Run at the speed of digital with Interfold.

Commercial lending can be long and painful, but it doesn’t have to be. Streamline the way you run with Interfold’s modern platform for bankers and borrowers.

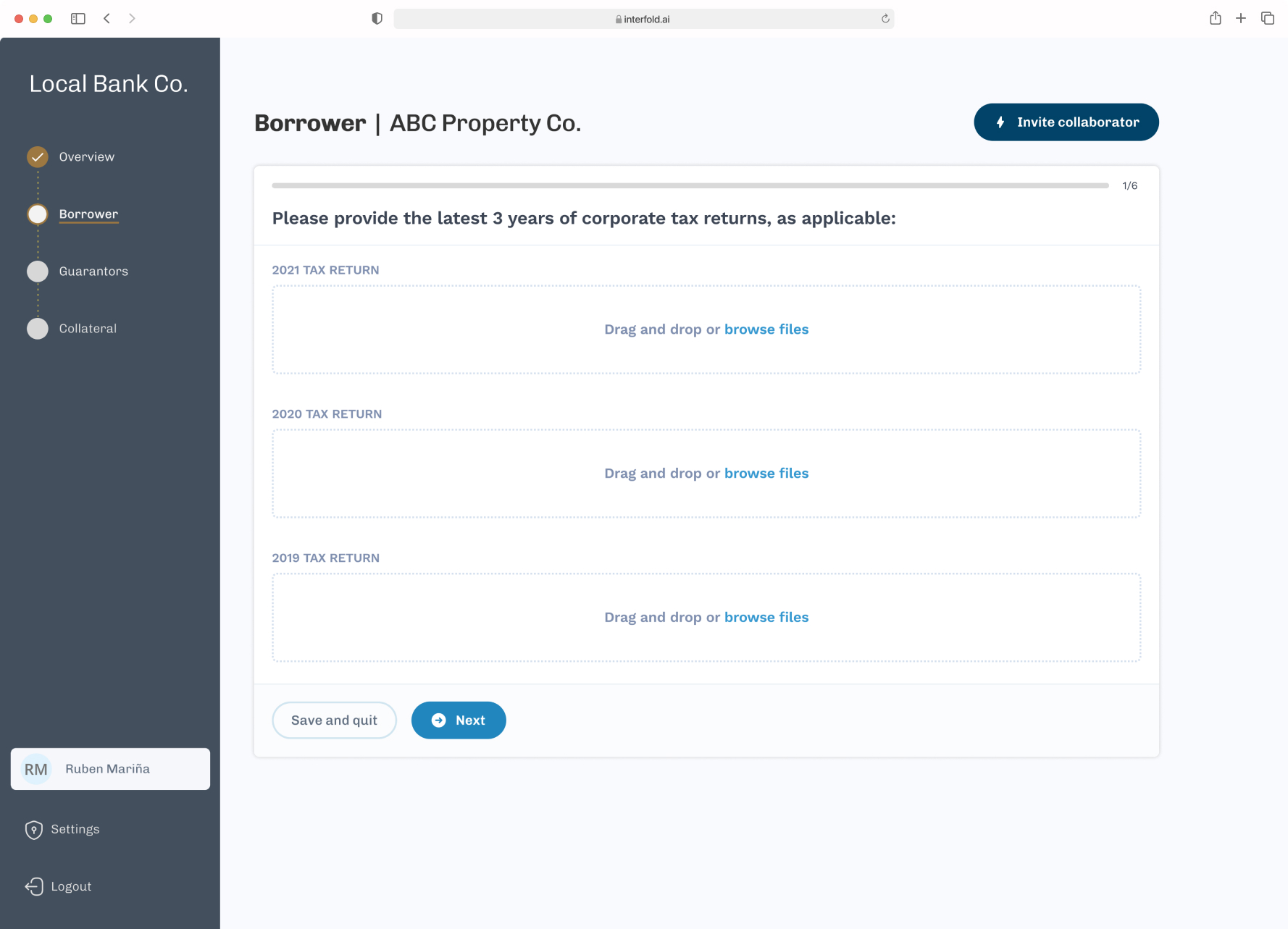

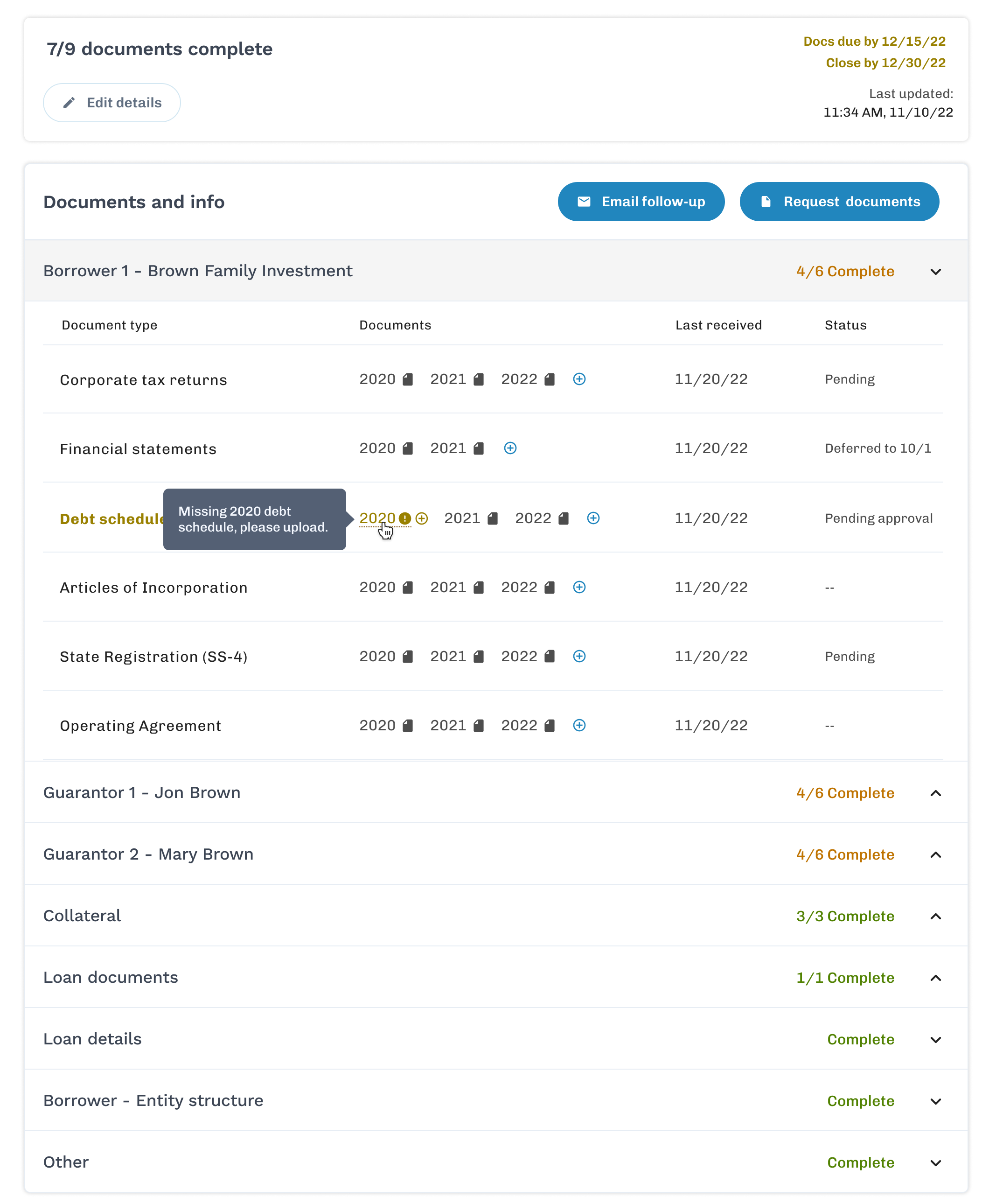

Close deals faster

Onboard borrowers automatically through a modern portal, with advanced AI capabilities.

Personalized reminders drive borrower engagement on autopilot, so lenders get to focus on growth, not administering documents.

Underwrite in seconds with AI

Extract and analyze financials in seconds, with advanced image recognition and AI capabilities.

Including financial spreading, CRE repayment analysis, guarantor cash flow, and more.

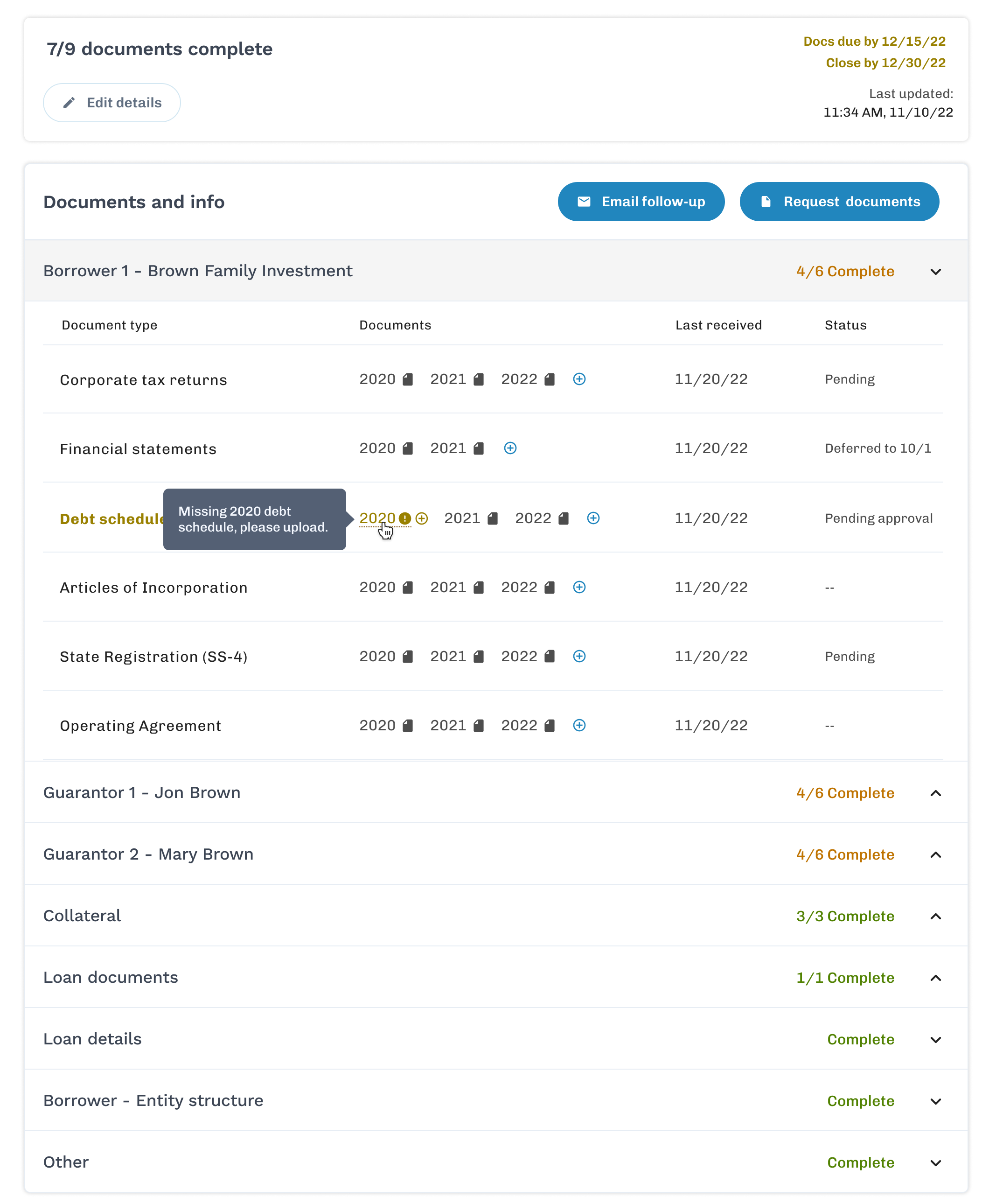

Autonomous loan reviews & monitoring

Interfold automatically goes out to clients for regular reporting and reviews, so credit teams are always up-to-date.

Modern borrower experience

Prevent loan delays and streamline the process.

All parties have visibility on required actions and progress. Automatically drive borrower action with personalized reminders.

Built with Powerful and Modern Features

.jpg)

.jpg)

.jpg)

.svg)

Security & Compliance

Interfold follows the highest security and compliance standards to reduce the compliance burden on your organization.

Read More On Security